Corporate Actions#

Adjusting prices for corporate actions#

We can use built-in functions to adjust price and volume for corporate actions.

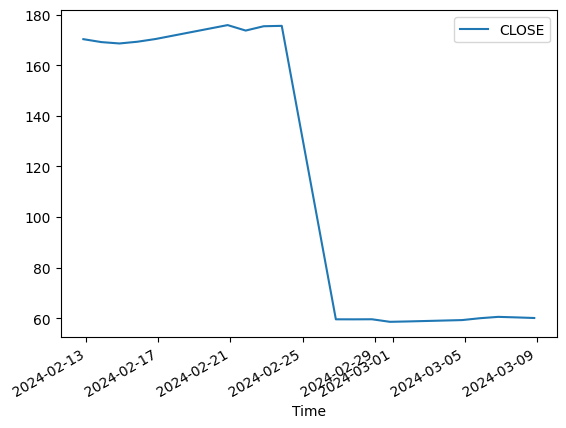

We follow an example of a 1:3 split for WMT on Feb 26, 2024. First let’s review the unadjusted data: there appears to be a price jump.

import onetick.py as otp

data = otp.DataSource('US_COMP_SAMPLE_DAILY', tick_type='DAY')

data = data[['CLOSE', 'VOLUME', 'EXCHANGE']]

data = data.where(data['EXCHANGE'] == '')

result = otp.run(data,

start=otp.dt(2024, 2, 10),

end=otp.dt(2024, 3, 10),

symbols='WMT')

result.plot(x='Time', y='CLOSE')

<Axes: xlabel='Time'>

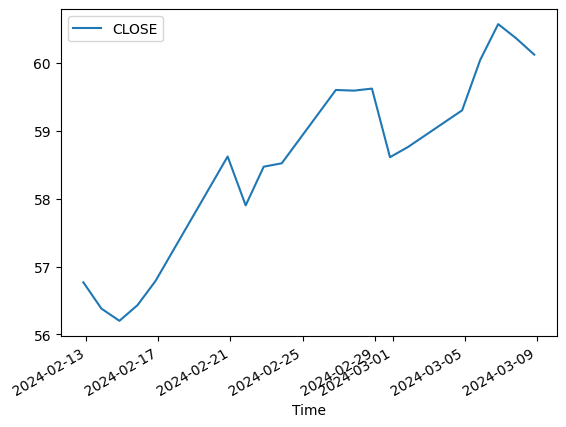

Adding adjustment for corporate actions fixes this.

The prices are adjusted to the level before or after the split depending on the value of the adjustement_date parameter.

The next example illustrates this:

data = otp.DataSource('US_COMP_SAMPLE_DAILY', tick_type='DAY')

data = data[['CLOSE', 'VOLUME', 'EXCHANGE']]

data = data.where(data['EXCHANGE'] == '')

data['ORG_CLOSE'] = data['CLOSE']

data = data.corp_actions(fields='CLOSE', adjust_rule='PRICE', apply_split=True)

result = otp.run(data,

start=otp.dt(2024, 2, 10),

end=otp.dt(2024, 3, 10),

timezone='America/New_York',

symbols='WMT',

symbol_date=otp.dt.now())

result.plot(x='Time', y='CLOSE')

<Axes: xlabel='Time'>

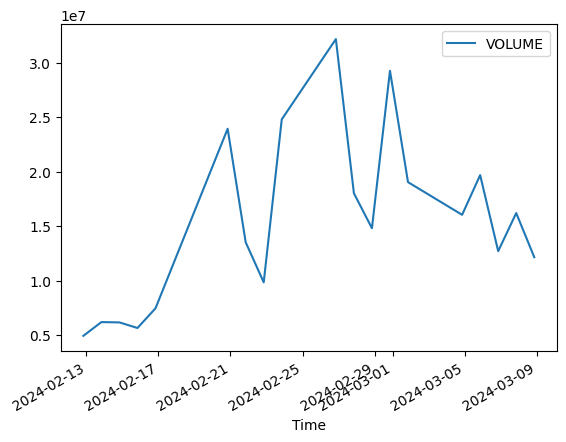

Adjustment can be applied to sizes in a similar way:

data = otp.DataSource(db='US_COMP_SAMPLE_DAILY', tick_type='DAY')

data = data[['CLOSE', 'VOLUME', 'EXCHANGE']]

data = data.where(data['EXCHANGE'] == '')

result = otp.run(data,

start=otp.dt(2024, 2, 10),

end=otp.dt(2024, 3, 10),

timezone='America/New_York',

symbols='WMT',

symbol_date=otp.dt.now())

result.plot(x='Time', y='VOLUME')

<Axes: xlabel='Time'>

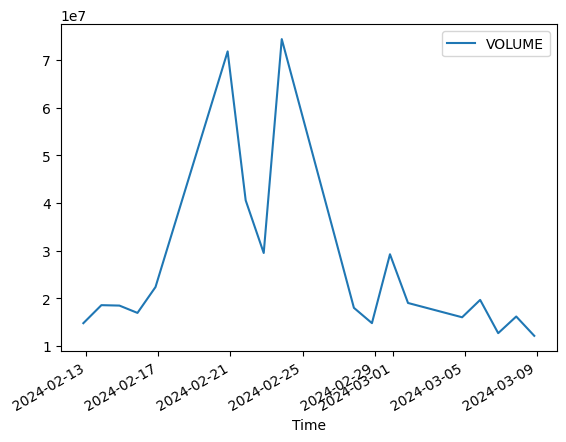

data = otp.DataSource(db='US_COMP_SAMPLE_DAILY', tick_type='DAY')

data = data[['CLOSE', 'VOLUME', 'EXCHANGE']]

data = data.where(data['EXCHANGE'] == '')

data['ORG_VOLUME'] = data['VOLUME']

data = data.corp_actions(fields='VOLUME', adjust_rule='SIZE', apply_split=True)

result = otp.run(data,

start=otp.dt(2024, 2, 10),

end=otp.dt(2024, 3, 10),

timezone='America/New_York',

symbols='WMT',

symbol_date=otp.dt.now())

result.plot(x='Time', y='VOLUME')

<Axes: xlabel='Time'>

Retrieving Corporate actions for a symbol#

We can retrieve all corporate actions for the symbols of interest:

db = otp.databases()['US_COMP_SAMPLE_DAILY']

db.ref_data(

ref_data_type='corp_actions',

start=otp.dt(2024, 2, 10),

end=otp.dt(2024, 3, 10),

timezone='America/New_York',

symbol='WMT',

symbol_date=otp.dt.now(),

)

| Time | MULTIPLICATIVE_ADJUSTMENT | ADDITIVE_ADJUSTMENT | ADJUSTMENT_TYPE | |

|---|---|---|---|---|

| 0 | 2024-02-26 | 0.333333 | 0.0 | SPLIT |